Will the Selling Continue Following Friday's Cattle on Feed Report?

Live Cattle

Technicals (June-M)

June live cattle futures broke lower on Friday on what could have been a round of profit taking ahead of Friday's Cattle on Feed report. That report showed On Feed at 101.3%, that was within the range of expectations and just fractionally above than the average estimate of 100.9%. Placements came in at 109.7%, that was above the upper end of estimates and 3.3% above the average estimate. Marketings came in at 103.4%, this was within the range of expectations and just .7% below the average estimate. All in all, the report had a bearish tilt to it which may add some follow-through pressure to start this week's trade. A retest of the low end of the recent range and the 50-day moving average is not out of the question, that comes in near 180. As mentioned for the last several weeks, this isn't a historically friendly time of year for live cattle, see seasonal chart below.

Resistance: 185.85-186.625*, 189.05

Pivot: 182.20

Support: 179.825-180.625**, 177.10

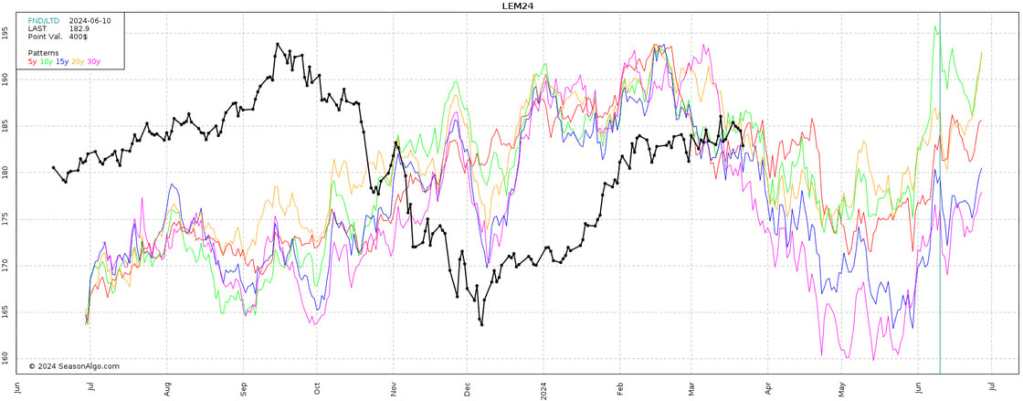

Seasonal Tendencies (June Live Cattle)

Below is a look at historical seasonality's (updated each Monday) VS today's prices (black line). Seasonally we start to see June futures soften up, but if you've been watching cattle at all over the last year you know that seasonals tendencies tend to have had a lower correlation this year.

*Past performance is not necessarily indicative of futures results.

Commitment of Traders Snapshot

(updated on Mondays)

Friday's Commitment of Traders report showed Fund positioning was little changed, holding a net long position of 62,391 futures/options contracts. Broken down that is 84,973 longs VS 22,582 shorts.

Continue reading the full article: Will the Selling Continue Following Friday's Cattle on Feed Report? - Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500