There's a Possibility USDA's Prospective Plantings Report Next Week Produces a Surprise in Corn

UDSA’s 2023 Prospective Plantings report was a shock to them market last year, with USDA showing farmers intended to plant nearly 92 million acres of corn. While the June 30 survey came in even higher, at 94 million acres of corn, the expectation is farmers will plant fewer corn acres in 2024; however, anything is possible in the report, analysts say.

“I just have kind of come to expect the unexpected in this report,” says John Payne of hEDGEpoint Global. “This is one that you can get the wild card. It wouldn't shock me to see USDA surprise us a little bit here and keep the acreage up.”

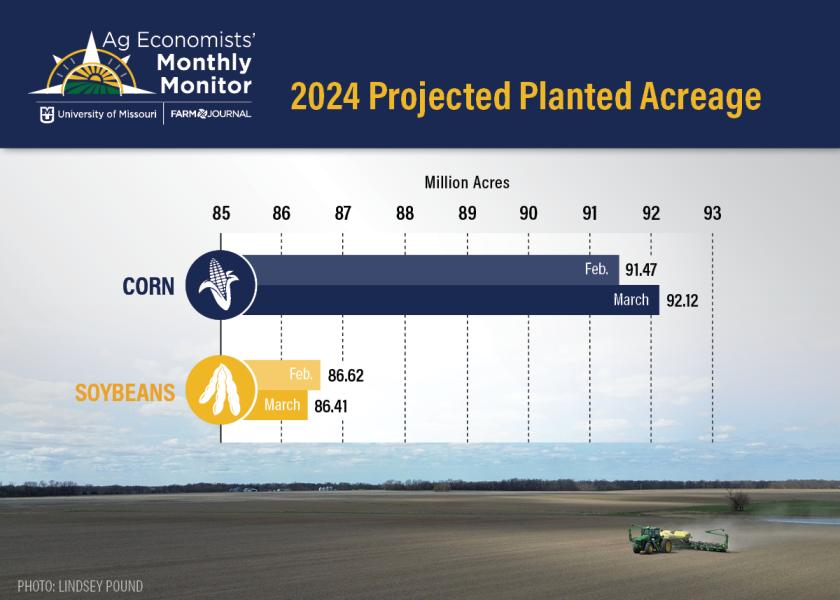

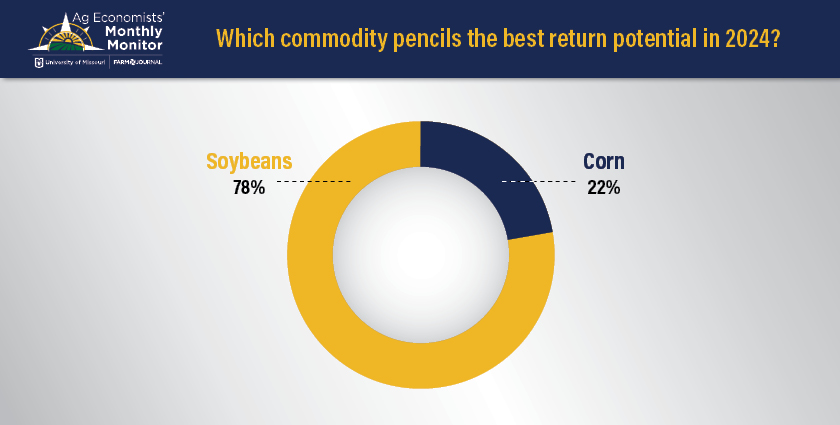

The March Ag Economists' Monthly Monitor, a survey of nearly 70 ag economists from across the country, found nearly 80% of those surveyed say soybeans pencils better than corn this year. But even with those economics, economists increased their corn acreage projections slightly from last month.

Economists increased their corn acreage projection slightly this month, to 92.12 million acres. That's up from the 91.47 million in February. The soybean acreage projection declined from 86.62 million to 86.41 million.

"As we think about plantings here in the united states, we're certainly seeing maybe an early spring that's allowed folks to get more fertilizer on more anhydrous on than we would have thought earlier. Perhaps that's going to increase corn acreage relative to what we've thought in the past," says Scott Brown, an ag economist with the University of Missouri who helps author the Monthly Monitor.

Payne says the anecdotal evidence points toward more soybean acres, but if history repeats itself, and the weather cooperates, corn acres could compete with last year's levels.

"Farmers here like plant corn us and at this point, given the early spring we've had, I think you could see corn acres somewhere close to where they were a year ago," says Payne.

So, what does the trade have baked in to the market at this point?

"The trade is definitely expecting that we're going to see less corn acres planted than last year," says Naomi Blohm, senior market adviser, Total Farm Marketing by Stewart Peterson. "The biggest takeaway is that there's going to be some ebb and flow throughout with what comes on the report. But the big picture, keep in mind, is that even if we plant 3 million less acres of corn than last year, we're still going to be battling 2 billion bushel carryout into the next growing season. So, that might keep the market prices suppressed in the short-term."

Blohm says in order for prices to rally significantly, something else will need to happen on the supply side.

"We're going to need something to happen with Brazil weather or some kind of a summer weather issue here in the United States later on in the summer," says Blohm.

Recap of the 2023 Prospective Plantings Report

The 2023 Prospective Plantings report showed farmers intended to increase their corn acreage. USDA's survey showed farmers who intended to plant nearly 92 million acres of corn, which is more than 1 million acres higher than pre-report estimates and a 3.42 million acre jump from 2022.

USDA’s March plantings report shows:

Corn: 91.9 million, up 4% from 2022

Soybeans: 87.51 million, up slightly from 2022

All Wheat: 49.9 million, up 9% from 2022

Cotton: 11.3 million, down 18% from 2022