Spring Cleaning

Market Watch with Austin Schroeder

March 28, 2024

Spring Cleaning

How fitting that in the first week and a half following spring officially starting that we have a snowstorm blow through the Midwest! You know, I don’t mind the moisture, but I just wish it would come in the form of a liquid on a warmer type of day. But I won’t complain. What the storm did impact was my normal work schedule. The icy roads and blowing snow left the wife and kids stranded with me at home. That isn’t at all bad, as I do love them and all, but the temptation for a distraction made it hard to stay on focus. With that said, it did allow the house to get an earlier start on a little spring cleaning before we have company over this weekend. Shifting focus to the market, there was likely some spring cleaning of its own going on. After all, it was the end of the month and quarter, so some profit taking and cleaning up of positions may have been in play. The Commitment of Traders data from last week suggest that there’s a long way to go before the shorts get all of their positions cleaned up!

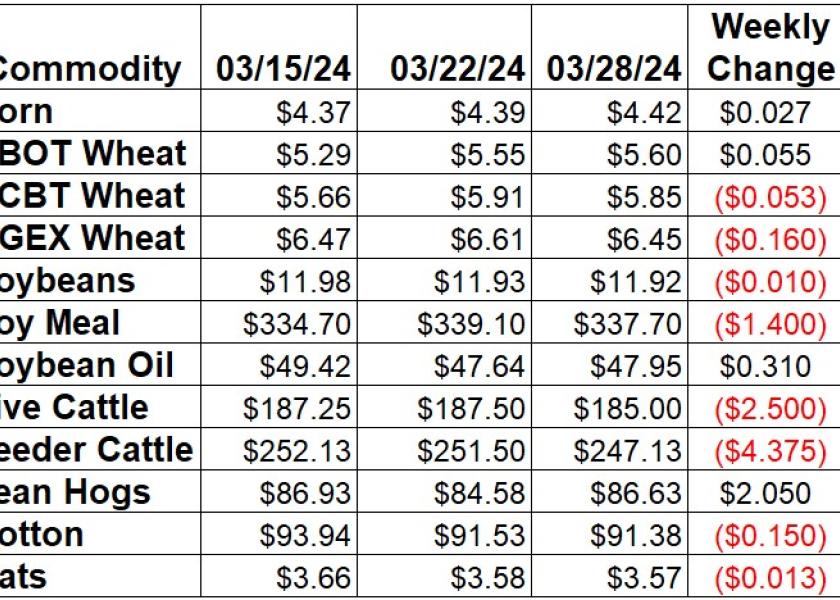

Corn fought back against some early week pressure with help from the USDA numbers, to post a 2 ¾ cent gain in nearby May on the week. That was the fifth consecutive higher weekly close! New crop December was up 2 ½ cents from last Friday. The big data for the week came on the last trade day, with some friendly numbers reported by USDA. The Prospective Planting report tallied corn acreage just over 90 million acres, which would be down 4.6 million vs. last year if realized and was below the 91.8 million acre estimate. The quarterly Grains Stocks report from NASS pegged March 1 corn stocks in the US at 8.347 billion bushels. That was up compared to last year, as expected, but by 950 mbu compared to the 1.05 bbu increase estimated. Weekly EIA data showed ethanol production rising another 8,000 barrels per day to 1.054 million bpd during the week of 3/22. Stocks were building again this week, up 83,000 barrels to 26.092 million barrels. The weekly Export Sales report tallied corn bookings back up slightly from last week at 1.2 MMT during the week that ended on March 21. Shipped and unshipped export commitments for corn are now 80% of the USDA forecast, compared to the average pace of 88% for this time of year. Actual shipments are 48% of the USDA number, still 2% below the average pace.

The wheat market was mixed this week. Chicago led the bull charge, with May up 5 ½ cents (0.99%). Kansas City was pulled to the downside, with a loss of 5 ¼ cents in the week. MPLS spring wheat futures fell ill with a larger acreage number from Thursday to post a 16 cent loss. The quarterly NASS Grains Stocks report pegged 1.087 bbu of wheat in storage across the US as of March 1. That was a 146 mbu increase from a year ago and 40 mbu above the trade expectation. Prospective Plantings data showed all wheat at 47.5 million acres, a 2.1 million acre drop from last year but 200,000 above the trade. Much of the heavier acreage came via spring wheat, which was up 440,000 acres vs estimates at 11.34 million. Winter wheat was 560,000 shy of the trade at 34.14 million acres. Export Sales data from Thursday morning tallied wheat at a 6-week high of 339,596 MT for the week of 3/21. New crop sales were down slightly vs. the previous week at 212,805 MT. US wheat export commitments are now 97% of the USDA full year export projection, 3% below the 5-year average pace and now 4% larger than the same point last year. Actual shipments are running a little slower, with 72% of the USDA forecast fulfilled compared to the 79% average.

Soybeans were in the middle of a tug-o-war with the product values this week and ultimately gave in to weakness, as May was down a penny. Meal was back down $1.40/ton, with bean oil the bull leader this week, up 31 points. The big annual Planting Intention report from USDA showed soybean acreage at 86.5 million acres expected for this spring. That would be up 2.9 million acres from last year but came in on the low side of estimates. Quarterly Grain Stocks data showed a less friendly number, as March 1 stocks were tallied at 1.845 billion bushels. That was 10 mbu above the average trade guess heading in and 158 mbu above last year. Export Sales data from Thursday showed beans pulling back to 263,859 MT for the week of March 21, a 4-week low. New crop sales were the second largest this MY at 120,000 MT. Export commitments for soybeans are now 86% of USDA’s forecast total, 7% below the 5-year average pace. Accumulated shipments are 77% of that total, matching the average pace.

Live cattle recovered some of the early week collapse in the last half of the week, but still closed with a $2.50 drop in April (-1.33%). Cash trade got kicked off a little earlier this week, with the short week, as the south traded hands at $185-186, a $2-3 drop from the week prior. In the north, cash trade was slower, with some dressed action at $299-300, $2-3 weaker from the week prior. Feeders were also pressured by the early week move, as April was down $4.375 (1.74%). The CME Feeder Cattle Index was back down 59 cents this week to $251.23. Wholesale boxed beef quotes backed off again this week. Choice boxes were down $2.36 at $308.36, while Select was 30 cents lower to $301.17. Weekly cattle slaughter this week through Thursday was at 483,000 head. That was an 8,000 head WTD increase from last week but is still 17,932 head below the same period last year. YTD slaughter is down 5.4% from a year ago at 7.61 million head. Beef export sales were tallied at a 3-week high of 12,654 MT, with shipment an 11-week low of 14,072 MT. Monthly Cold Storage data showed beef stocks at 442.75 million lbs at the end of February. That was down 11.59% from last year and a 6.05% drop vs. last month.

Hogs were busy adding in some premium this week as April was up $2.05 since last Friday (+2.42%), with June up $1.75 (+1.76%). The CME Lean Hog Index was another 71 cents higher this week at $84.25. The quarterly Hogs & Pigs report from NASS on Thursday showed 74.57 million head of hogs on hand across the US, up 0.59% from last year. That increase came in the market hog inventory, up 0.83% at 68.556 million head, with the breeding herd down 2.12% at 6.016 million head. USDA’s Pork Carcass Cutout was up just 15 cents this week (0.2%) to $94.52. The belly (-5.5%), rib (-5.8%), picnic (-3.3%), and butt (-0.2%) were all lower this week. Estimated hog slaughter so far this week is at 1.946 million head. That is 6,000 head shy of the previous week through Thursday, and 15,390 head above the same week last year. The YTD hog slaughter has run just 0.8% above last year. Weekly Export Sales data showed pork sales improving to the largest since December 2022 at 55,319 MT. Export shipments were back up this week to 34,199 MT. Pork stocks in cold storage were tallied at 456.5 million lbs on Feb 29. That was a 12.48% drop from 2023 and down 1.47% from January in a contraseaonal move.

Cotton continued to pull back, albeit just slightly this week, despite a friendlier acreage number on Thursday. May was down just 15 points since last Friday, with new crop December up 4 points. The annual March planting intentions data from USDA showed that US cotton producers expect to plant 10.67 million acres of cotton this spring. That would be up 470,000 acres from last year, but was well shy of the 11.3 million acres estimated coming in. The weekly Export Sales report pegged old crop upland cotton export bookings at 98,150 RB, a 5-week high, with new crop the second largest this MY at 72,225 RB. Old crop commitments are still running at a solid pace for 23/24 at 10.805 million RB, which is 93% of USDA’s current cotton export forecast. That is 8% back of the 101% average pace for this point in the MY. Shipments were backing off of last week’s MY high at 360,721. That took the MY total to 58% of the USDA forecast, 2% ahead of the average pace. The FSA cut the Adjusted World Price for cotton by 1.62 cents on Thursday, to 70.88 cents/lb.

Market Watch

We start off next week in a new month, and on April Fool’s Day to boot. Export Inspections data will be released on Monday morning, with the first Crop Progress report of the season out from NASS that afternoon. We will also get the monthly domestic use data via the Grain Crushings, Fats & Oils, and Cotton Systems reports on Monday. On Wednesday, EIA will release the weekly ethanol stocks and production report. Thursday will show the weekly Export Sales report, with Census also releasing the monthly export data from February. April live cattle options expire on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.